Following a period of escalating prices, Canada’s housing market is cooling. Measures designed to strengthen financial stability such as more stringent tests of borrowers’ ability to repay their loans, along with higher interest rates, combined to make mortgage financing more expensive. As a result, residential mortgage credit slowed to just 3.4 percent annual growth in December 2018.

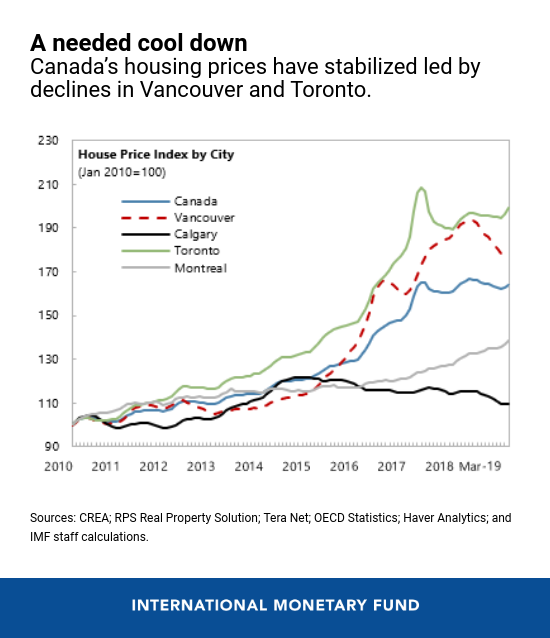

Nationwide, house prices are 2.5 percent lower than the peak in mid-2018. This week’s chart of the week shows that prices in most major cities have stabilized. In Toronto and Vancouver, declines in house prices reduced speculative “froth” but prices remain overvalued.

Overall, policies that strengthen financial stability succeeded in containing housing-related financial stability risks. While the stock of household debt remains high at 176 percent of disposable income, reductions in housing market imbalances contributed to somewhat lower near-term risks to growth and financial stability.

Nevertheless, in its latest assessment of the Canadian economy, the IMF noted that persistent housing market imbalances remain a key domestic risk factor. A sharp reversal in housing market prices, particularly if accompanied by a rise in unemployment and a collapse in people’s consumption, could spark additional risks to financial stability and growth.